Automated trading has changed how people approach the forex market. Instead of watching charts all day, traders now use sophisticated software to scan markets, identify opportunities, and execute trades automatically. The Korvato trading bot represents this shift toward algorithmic decision-making in currency trading.

For tech-savvy traders curious about how artificial intelligence actually functions in live trading environments, understanding the mechanics behind these systems matters. This article breaks down how Optimus AI processes market data, makes trading decisions, and manages risk without human intervention.

The Korvato trading bot uses machine learning algorithms to analyze real-time forex data and execute trades automatically. The system monitors multiple currency pairs simultaneously, identifies patterns that suggest market inefficiencies, and places trades based on mathematical probability rather than human emotion.

The Core Technology Behind Optimus AI

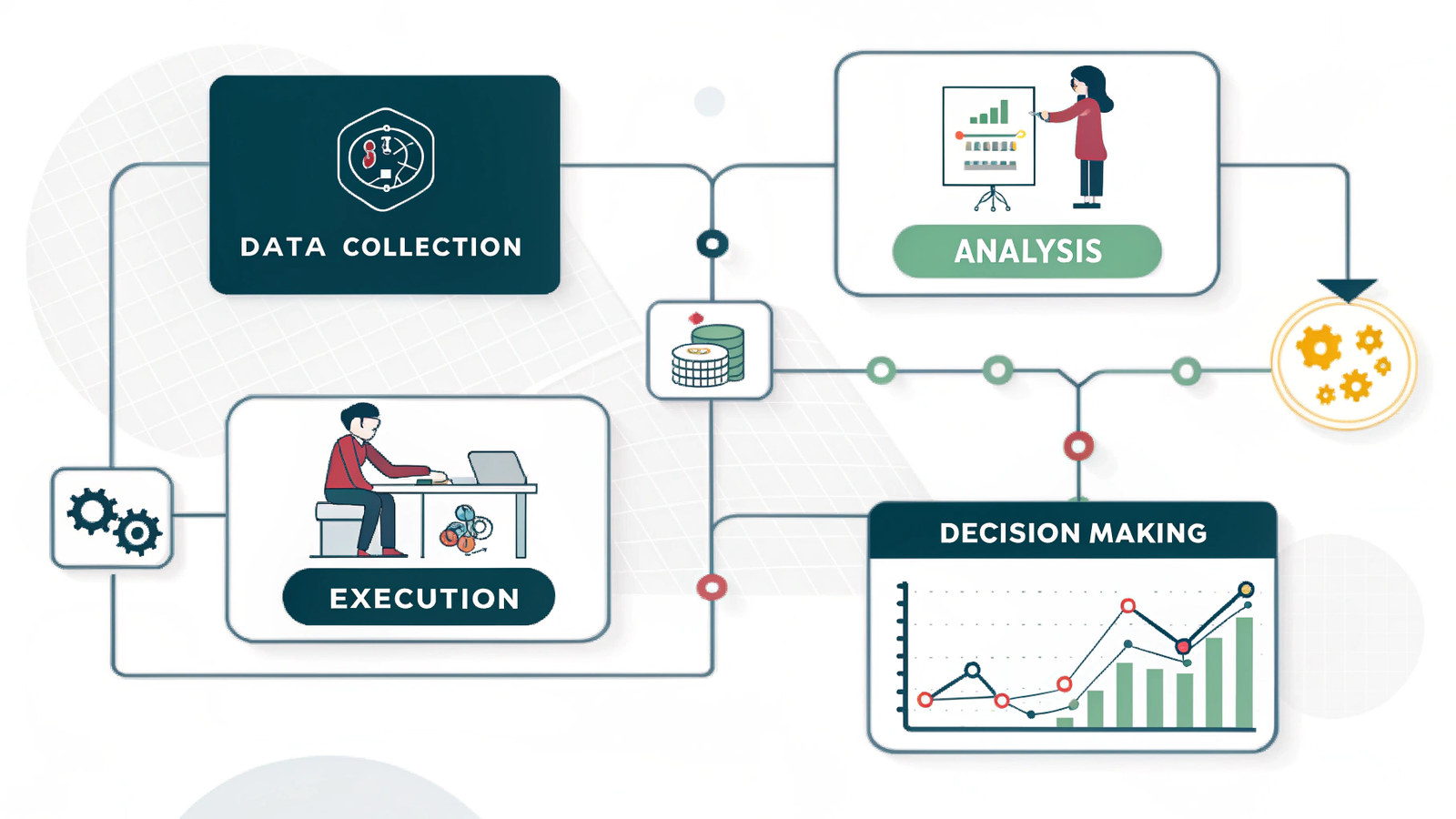

At its foundation, the Optimus AI system operates on three interconnected components: data ingestion, pattern recognition, and execution logic. Each component serves a specific function in the trading process.

The data ingestion layer connects to forex market feeds and pulls price information in real time. This includes bid-ask spreads, trading volume, and price movements across multiple currency pairs. The system processes this information continuously, building a current picture of market conditions.

Pattern recognition represents where machine learning trading capabilities become relevant. The algorithms search for specific mathematical patterns in price behavior that historically precede profitable trading opportunities. These patterns might include momentum shifts, volatility changes, or correlation breakdowns between related currency pairs.

The execution layer takes the insights from pattern recognition and converts them into actual trades. This component manages order placement, position sizing, and timing. Speed matters here because forex markets move quickly, and delays of even seconds can impact trade outcomes.

Unlike manual trading where a person must watch charts and click buttons, this automated approach operates around the clock. The best AI trading bot systems never sleep, maintaining constant market surveillance even when traders are away from their computers.

How Machine Learning Adapts to Market Conditions

Machine learning trading differs from simple automated trading in one key way: adaptation. Traditional automated systems follow fixed rules programmed by developers. If market conditions change, these systems continue executing the same logic regardless of effectiveness.

The Optimus AI system uses algorithms that adjust based on performance feedback. When certain pattern types consistently lead to profitable trades, the system increases weighting toward those patterns. When other signals produce poor results, the algorithms reduce their influence on trading decisions.

This adaptation happens through mathematical optimization rather than conscious thought. The system evaluates thousands of potential parameter combinations, testing which configurations would have performed best on recent market data. It then adjusts its internal settings accordingly.

However, this learning process has limits. The algorithms work within boundaries set by their underlying architecture. They cannot invent entirely new trading strategies or understand fundamental economic events like central bank policy changes. The system recognizes mathematical patterns in price data, not the reasons behind price movements.

For traders researching Korvato results, understanding this distinction matters. The technology excels at identifying technical patterns and executing trades with consistency, but it operates within defined parameters rather than possessing general intelligence.

Risk Management and Position Sizing

Effective forex automation requires sophisticated risk controls. Without proper safeguards, automated systems can accumulate excessive losses during unfavorable market periods. The Optimus AI system incorporates several risk management mechanisms.

Position sizing determines how much capital to allocate to each trade. The system calculates position size based on account balance, currency pair volatility, and the specific setup’s historical success rate. Higher-probability setups might receive larger allocations, while experimental patterns get smaller position sizes.

Stop-loss placement happens automatically for every trade. The system calculates stop-loss levels based on recent volatility measurements and the specific pattern being traded. This ensures that no single trade can cause catastrophic account damage.

Exposure limits prevent the system from concentrating too much capital in correlated positions. If multiple currency pairs move together during certain market conditions, the system recognizes this correlation and limits total exposure across related positions.

Drawdown controls monitor cumulative losses over specific time periods. If losses exceed predetermined thresholds, the system can reduce position sizes or temporarily pause trading until market conditions stabilize. This protects capital during extended unfavorable periods.

Users maintain control over risk parameters. Those who Korvato invest with can adjust maximum drawdown limits, position sizing aggressiveness, and which currency pairs the system trades. The automation handles execution, but traders set the boundaries.

The Trading Process From Signal to Execution

Understanding how the system moves from identifying opportunities to placing actual trades reveals the practical mechanics of AI trading algorithms. The process follows a structured sequence:

- Market Scanning: The system continuously monitors configured currency pairs, updating price data multiple times per second.

- Pattern Detection: Algorithms compare current price behavior against thousands of stored patterns to identify potential setups.

- Probability Assessment: When a pattern match occurs, the system calculates the statistical likelihood of a profitable outcome based on historical data.

- Risk Evaluation: The system checks whether taking this trade fits within current exposure limits and risk parameters.

- Order Placement: If all criteria are met, the system sends the trade order to the broker, including entry price, stop-loss, and take-profit levels.

- Position Monitoring: Once the trade is active, the system tracks price movement and can adjust stop-loss levels or close positions based on evolving conditions.

- Performance Logging: After trade closure, results feed back into the learning system to refine future decision-making.

This entire sequence happens in milliseconds. Human traders cannot process information and execute trades at this speed, which represents a key advantage of algorithmic approaches.

The system handles multiple positions simultaneously across different currency pairs. It can manage the complexity of tracking numerous trades with different entry points, stop-losses, and profit targets without confusion or oversight errors.

Limitations and Realistic Expectations

No trading system wins on every trade. The forex market contains inherent unpredictability that no algorithm can eliminate completely. Understanding limitations helps traders maintain realistic expectations.

The Optimus AI system experiences losing trades. Profitable trading means winning more often than losing, or winning larger amounts than losses, not achieving 100% accuracy. Drawdown periods occur when market conditions temporarily favor patterns outside the system’s recognition capabilities.

Past performance does not guarantee future results. Market structure changes over time as new participants enter, regulations shift, and economic conditions evolve. Patterns that worked previously may become less reliable.

The system requires proper capitalization. Accounts with insufficient capital relative to position sizes face higher risk of significant drawdowns. Adequate funding allows the system to weather normal losing streaks without depleting the account.

Broker execution quality impacts results. The AI trading algorithm generates signals, but actual trade execution depends on broker infrastructure. Slippage, requotes, and connection issues can affect practical outcomes versus theoretical performance.

Users bear responsibility for their trading decisions. While the system automates execution, traders choose whether to activate the bot, which risk settings to apply, and how much capital to allocate. These remain individual investment choices with associated risks.

| System Capability | What It Does | What It Doesn’t Do |

|---|---|---|

| Market Analysis | Identifies technical patterns in price data | Predicts economic news or policy changes |

| Trade Execution | Places orders automatically at optimal speed | Guarantee fills at exact desired prices |

| Risk Management | Applies consistent stop-losses and position sizing | Eliminate all possibility of losses |

| Adaptation | Adjusts parameters based on performance data | Understand fundamental market changes |

What This Means for Traders

The Korvato trading bot represents a tool rather than a guaranteed profit generator. It removes emotional decision-making, operates continuously, and executes trades with consistency that humans cannot match. For tech-savvy traders comfortable with algorithmic approaches, these capabilities offer advantages over manual trading.

The system works best for traders who understand forex market basics, recognize that losses are part of trading, and want to automate execution while maintaining control over risk parameters. It provides institutional-level technology to individual traders who previously lacked access to such sophisticated tools.

All forex trading involves substantial risk. Automated systems do not eliminate this risk; they manage it through mathematical consistency. Traders should only invest capital they can afford to lose and should understand how the technology functions before activating automated trading.